After focusing for decades on cutting costs, the solar industry is shifting attention to making new advances in technology.

The solar industry has spent decades slashing the cost of generating electricity direct from the sun. Now it’s focusing on making panels even more powerful.

With savings in equipment manufacturing hitting a plateau and more recently pressured by rising prices of raw materials, producers are stepping up work on advances in technology — building better components and employing increasingly sophisticated designs to generate more electricity from the same-sized solar farms. New technologies will create further cost-of-electricity reductions.”

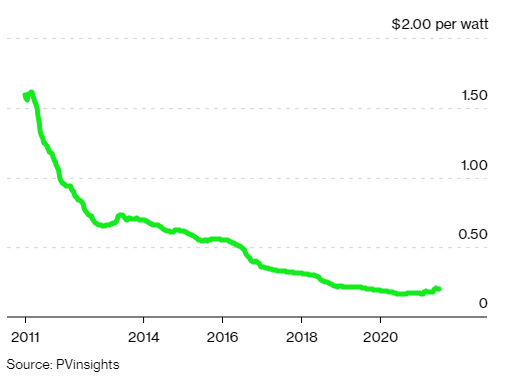

Solar Slide

Photovoltaic panel cost declines have slowed in recent years.

A push for more powerful solar equipment underscores how further cost reductions remain essential to advance the shift away from fossil fuels. While grid-sized solar farms are now typically cheaper than even the most advanced coal or gas-fired plants, additional savings will be required to pair clean energy sources with the expensive storage technology that’s needed for around-the-clock carbon-free power.

Bigger factories, the use of automation and more efficient production methods have delivered economies of scale, lower labor costs and less material waste for the solar sector. The average cost of a solar panel dropped by 90% from 2010 to 2020.

Boosting power generation per panel means developers can deliver the same amount of electricity from a smaller-sized operation. That’s potentially crucial as costs of land, construction, engineering and other equipment haven’t fallen in the same way as panel prices.

It can even make sense to pay a premium for more advanced technology. We’re seeing people willing to pay a higher price for a higher wattage module that lets them produce more power and make more money off their land. Higher-powered systems are already arriving. More powerful and highly-efficient modules will reduce costs throughout the solar project value chain, supporting our outlook for significant sector growth over the next decade.

Here are some of the ways that solar companies are super-charging panels:

Perovskite

While many current developments involve tweaks to existing technologies, perovskite promises a genuine breakthrough. Thinner and more transparent than polysilicon, the material that’s traditionally used, perovskite could eventually be layered on top of existing solar panels to boost efficiency, or be integrated with glass to make building windows that also generate power.

Bi-facial Panels

Solar panels typically get their power from the side that faces the sun, but can also make use of the small amount of light that reflects back off the ground. Bi-facial panels started to gain in popularity in 2019, with producers seeking to capture the extra increments of electricity by replacing opaque backing material with specialist glass.

The trend caught solar glass suppliers off-guard and briefly caused prices for the material to soar. Late last year, China loosened regulations around glass manufacturing capacity, and that should prepare the ground for more widespread adoption of the two-sided solar technology.

Doped Polysilicon

Another change that can deliver an increase in power is shifting from positively charged silicon material for solar panels to negatively charged, or n-type, products.

N-type material is made by doping polysilicon with a small amount of an element with an extra electron like phosphorous. It’s more expensive, but can be as much as 3.5% more powerful than the material that currently dominates. The products are expected to begin taking market share in 2024 and be the dominant material by 2028, according to PV-Tech.

In the solar supply chain, ultra-refined polysilicon is shaped into rectangular ingots, which are in turn sliced into ultra-thin squares known as wafers. Those wafers are wired into cells and pieced together to form solar panels.

Bigger Wafers, Better Cell

For most of the 2010s, the standard solar wafer was a 156-millimeter (6.14 inches) square of polysilicon, about the size of the front of a CD case. Now, companies are making the squares bigger to boost efficiency and reduce manufacturing costs. Producers are pushing 182- and 210-millimeter wafers, and the larger sizes will grow from about 19% of the market share this year to more than half by 2023, according to Wood Mackenzie’s Sun.

The factories that wire wafers into cells — which convert electrons excited by photons of light into electricity — are adding new capacity for designs like heterojunction or tunnel‐oxide passivated contact cells. While more expensive to make, those structures allow the electrons to keep bouncing around for longer, increasing the amount of power they generate.

Post time: Jul-27-2021